Building a Data-Driven Credit Union Industry

by Hannah Barrett, on November 16, 2021

The quest for clean data for effective analytics and efficient decision-making is all too familiar. It can feel like quite the beast for credit unions to tackle, depending on what resources they have available.

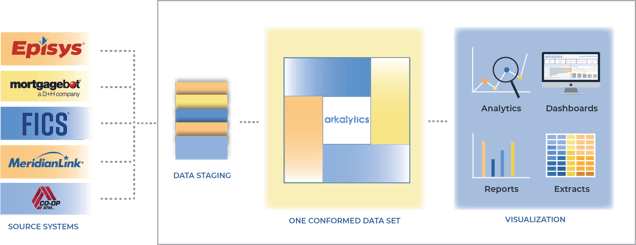

Arkalytics is a fully-managed data analytics platform that connects all of your data sources and centralizes them in one place for in-depth analysis. From loan originations, social media, your marketing platform and CRM...to your core, online banking system, credit card processor, and more.

With our data quality rules engine, Arkalytics cleanses and conforms all of this data so it is ready to be used for analytics, and prepared for use with any vendors.

This allows your credit union to:

- Uncover valuable insights, create automated reports

- Build trust in these datasets through measurable data quality metrics

- Easily connect & share data with mission critical vendors

This will result in time-savings, alignment of KPI's to strategic goals, and a multitude of opportunities for your credit union to become more data-driven.

Leverage your data analytics ecosystem to integrate with key partners by streamlining the flow of data between third-parties such as the NCUA, a CRM or marketing provider, and even valuable AI providers.

Cleaner, conformed data also makes it possible to anonymously share benchmarking data and impact data across the industry, strengthening the credit union mission as a whole; data connects us all!

Want to learn more about leveraging this technology for your credit union?