10 KPIs Every Credit Union Should be Measuring

by Hannah Barrett, on September 2, 2021

Tracking Credit Union Performance Metrics

Credit Union performance can be measured by a large range of key performance indicators (KPI's) and metrics. Many times, the metrics that you track will vary depending on your strategic goals.

Are we focused on growing members, saving money on operational costs, or managing employee efficiency? Each one of these has a different calculation that we can track and measure. Capturing these data points with a data warehouse can help you understand how your performance changes over time.

Use these 10 Credit Union KPI's as a starting point on your journey to becoming more data-driven. If you need more ideas, contact us to learn more!

Tracking Made Easy

With Arkalytics dashboards, credit unions can easily view all of the necessary metrics to monitor business performance and visualize daily changes, trends, and correlations. The insights generated from these dashboards are the key to improving overall business performance.

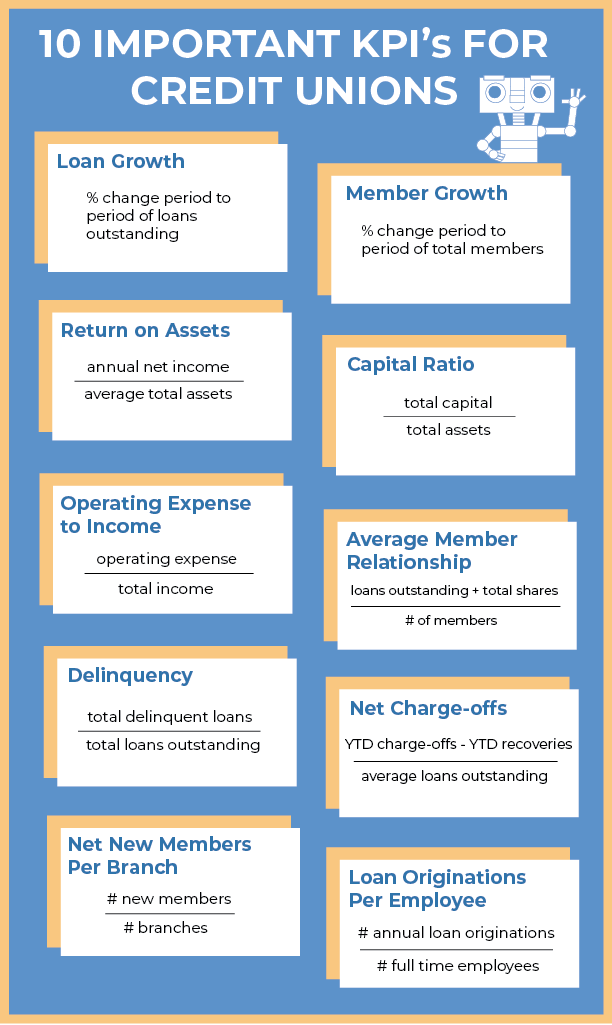

10 Credit Union KPI's to Track Performance

Below is a description of just ten of the many KPI's that your credit union can measure, using Arkalytics, to improve performance in a multitude of areas.

- Loan Growth

- Member Growth

- Return on Assets

- Capital Ratio

- Operating Expense to Income

- Average Member Relationship

- Delinquency

- Net Charge-Offs

- Net New Members Per Branch

- Loan Originations Per Employee

1. Loan Growth

The loan growth ratio reflects the ability of a credit union to penetrate its prospective loan market through marketing, product development, sales culture development, and the use of multiple delivery channels. Loan growth is affected by multiple factors:

- The state of the economy

- Membership demographics

- Level of risk that the credit union can handle

- The credit union's ability to gain market share

Demographic factors:

- Number of borrowing age members

- How affluent the membership is

- Cultural attitudes about debt and borrowing

2. Member Growth

Implementation of effective business strategies within the credit union's marketplace will lead to member growth. Member growth strategies are driven by the board's philosophy around:

- Service levels

- Delivery channels

- Product pricing

- The breadth of services offered

Having a substantial amount of members is a good goal for a credit union's member growth, but it's important to keep in mind the quality of members too, and to continue to put in the work to convert new members to users of additional products and services aside from what initially made them begin their membership.

3. Return on Assets

ROA is a key indicator of a credit union’s profitability. The number reflects how efficiently management is running the credit union by showing how much income is generated for each dollar of assets deployed. In general, a high ROA reflects management’s success at utilizing its assets to generate income. Credit unions; however, should view ROA under the lens of their institution’s individual strategy.

4. Capital Ratio

The capital ratio is a measure of liquidity, and while this ratio shouldn't be allowed to get too low, a very high percentage is also not ideal, as it indicates that a credit union may not be using its assets productively.

5. Operating Expense to Income

A credit union's operating expense-to-income ratio describes its ability to generate income from products and services. The expenses of a credit union may be higher depending on the extent of their offerings, so it comes down to the balance of income coming in from those offerings, and the expense of also having more offerings. If credit unions stay competitive with their product-pricing strategy, that may result in a strong expense-to-income ratio.

6. Average Member Relationship

The average member relationship represents the average value of loans and deposits an individual member has with the credit union. The credit union’s pricing strategy, underwriting policies, and product mix are all contributing factors in measuring this performance. There are also of course external factors at play, such as the makeup of the field of membership, the current economic environment, and the credit union’s ability to sell loan and deposit products.

7. Delinquency Ratio

A credit union’s delinquency ratio is a measure of the current credit risk associated with the credit union’s loan portfolio. The delinquency ratio aids in forecasting future loan losses. The level of delinquency a credit union can sustain is determined by several factors:

- Income generated by the loan portfolio

- Management of credit risk

- Ability to manage loan losses

8. Net Charge-offs

The net charge-offs to loans ratio measures the credit union’s past management of credit risk. In general, credit unions can count on a lower number being an indicator of healthy credit risk management. This ratio has a direct impact on the credit union’s ROA. The two primary pieces of credit risk management that impact this ratio are underwriting policies and debt collection procedures. This ratio is impacted by:

- Risk-based pricing

- Membership demographics

- Loan mix

- Timeliness & aggressiveness of collection efforts

9. Net New Members Per Branch

Net new members per branch is a great measurement of the productivity of a credit union’s marketing expenses and employee selling initiatives. This gives the ability to quantify success and necessity of their advertising and promotional expenses.

10. Loan Originations Per Employee

This ratio determines how effective a credit union’s employees are at generating member loans. The higher the ratio, the overall more productive the employees are at generating member loans. Some components that affect this ratio are:

- The credit union’s lending philosophy

- Employee training programs

- The members’ propensity to borrow

Want to learn more about leveraging Arkalytics dashboards as a tool to measure your credit union's KPIs?

References:

https://go.callahan.com/rs/866-SES-086/images/Benchmarking%20Guide%202019_Final.pdf