Loan Portfolio Analysis for Credit Unions

by Hannah Barrett, on July 19, 2022

In this blog we will cover why loan portfolio analysis is important and how analyzing your loan portfolio can be beneficial.

We will share a few use cases to help you envision some ways to do this, and outline what questions you will be able to answer afterwards. We will also outline how this analysis can be done using Arkalytics dashboards.

Why is loan portfolio analysis important?

It's important for credit unions to have the proper tools they need to easily track and analyze their loan operations in order to view the distribution loan types. Additionally, credit unions typically evaluate and manage the level of risk or exposure associated with specific loan types, such as residential vs commercial property loans.

Performing loan portfolio analysis is vital to determine if the credit union has a strong balance and diversification of loans, as well as to determine marketing strategies for each type of loan.

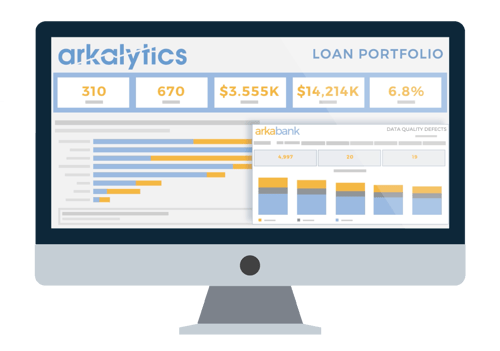

Tracking KPI's help determine where your credit union's loan portfolio stands in a number of areas. Here are some examples of key KPI's you can track and measure with a loan portfolio dashboard:

- Loan payoffs

- Loans opened

- Charge-offs

- Loan delinquencies

- Recoveries

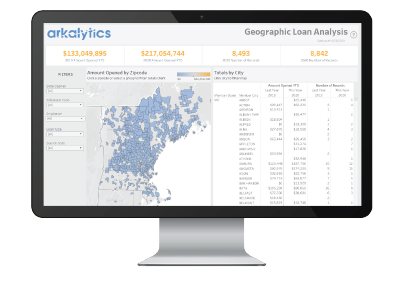

When you have questions to ask of your loan portfolio, how do you find answers quickly? Here are some examples of questions you will be able to answer quickly using a flexible loan portfolio dashboard.

Loan Analysis

- How many loans has your credit union given out in the past week, month, year?

- What is the total amount outstanding vs. the total amount loaned out?

- What is the average loan interest rate for each type of loan?

- How do these numbers affect your bottom line, and where do you want them to be?

- How are your loans distributed geographically?

- Which loans are the most popular this quarter?

- What is the median age of members taking out auto loans?

- How many open loans are during this particular time period?

Loan Maturity

- How many loans are maturing versus how many are being opened? Is your credit union generating more business than it is terminating? (loans being paid off)

- What types of loans are maturing?

- Who amongst your branches is originating different types of loans?

Analyze these attributes of past due loans, and break down your loan portfolio by a host of different metrics.

Loan portfolio analysis made easy

With our loan portfolio analysis dashboards, technical skills and knowledge of SQL are not necessary. Simply filter the areas you want to look at, and get the answers you need!

The Arkalytics loan workbench visualization tool acts like a query builder and provides the user a way to dig into the metrics and attributes of their loan portfolio and the members that hold those accounts.

View loans by source and status, slice and query the data by any specific variables you would like to look at. Wondering how many loans have a certain amount outstanding, or what the average credit score is on a certain grouping of loans? Find the answers to these questions easily.

Analyzing Auto Dealers & Indirect Loans

Manage your auto loan portfolio. Easily answer questions such as:

- Who are the top auto lenders and how do they compare to each other?

- What are the dealer trends?

- What is the average credit score for loans by each dealer?

With this information, you will be able to determine which of your dealers have the lowest credit scores, so you can reach out and act accordingly. Or alternatively, boost your relationship with the highest performing dealers.

How will you use loan portfolio analysis to drive business at your credit union or banking institution?