How Tucson Federal Credit Union Saved Members $100's of Dollars in Interest Payments Monthly

by Hannah Barrett, on September 19, 2023

Tucson Federal Credit Union (TFCU) was established in 1937 in Tucson, Arizona when a group of teachers with a vision came together to form a financial cooperative that could better serve the financial needs of Tucson’s school employees and their families. Today, TFCU has grown to 60,000 members and $650 million in assets.

TFCU is utilizing Arkalytics to better serve their members and community. One way they're doing this is by offering laser-targeted credit card promotions via email to help their most vulnerable members including those who have struggled with climbing interest rates caused by Increasing federal reserve rates. They're making the best payments they can, but most of that payment is going to interest.

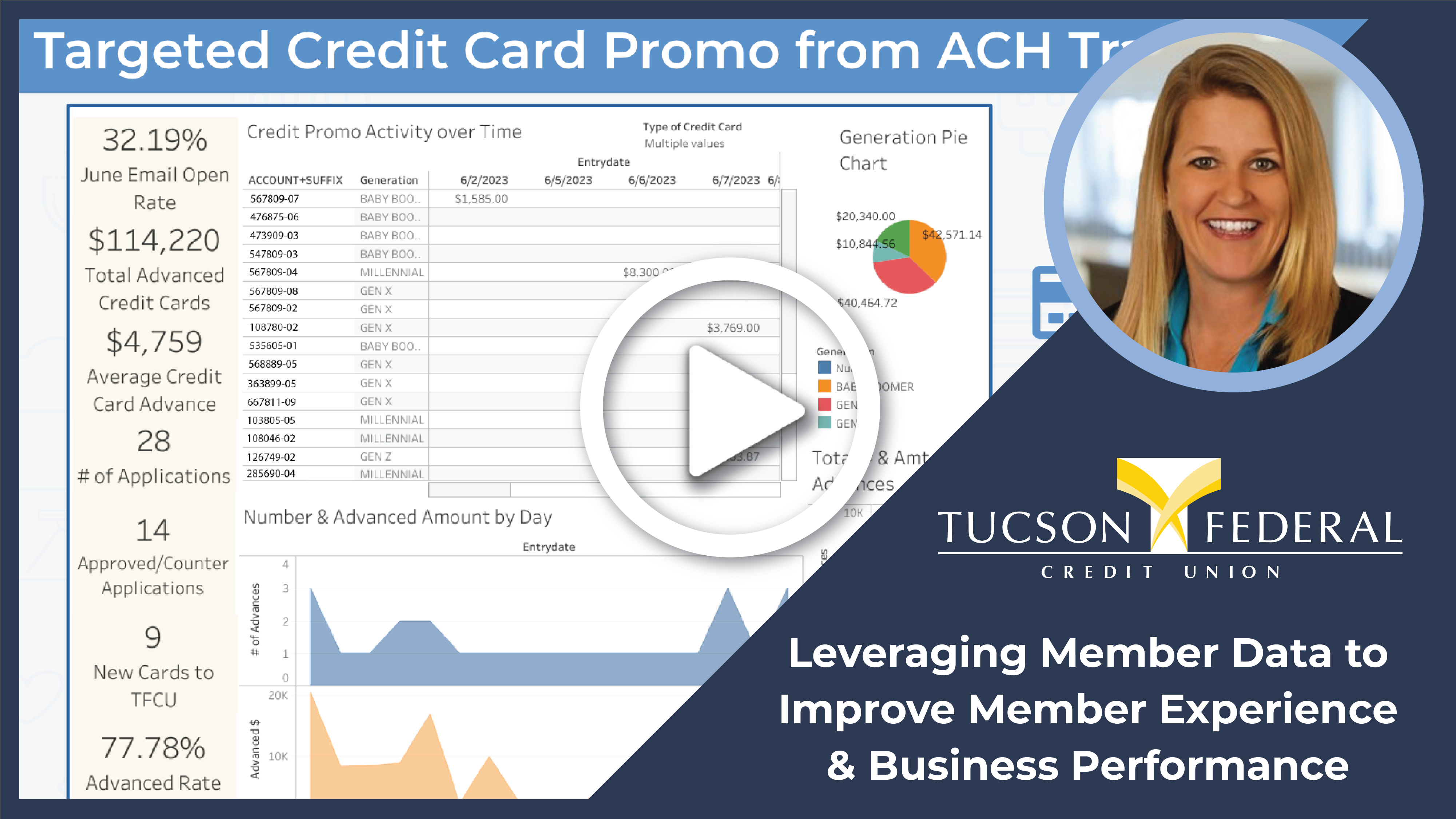

The TFCU team utilized Arkalytics to build a dashboard & model to analyze:

- How many emails were opened?

- How many approved applications?

- How many new credit card applications?

- How many new cards to TFCU?

Using this dashboard, they analyzed two segments:

- Members who have a TFCU credit card, but are making a payment to another financial institution's credit card

- Members who DON'T have a TFCU credit card, but are making a payment to another financial institution's credit card

This resulted in:

- 32% email open rate

- 28 new applicants

- 9 new TFCU credit cards

The promotion offers members a 0.00% APR for the first 12 months. After the promotion ends, many members lowered their overall credit card rate to as low as 15.75% APR! This saved members hundreds of dollars in interest payments and improved members’ overall financial well-being. Past credit card promos show that 68% of balances were retained and new purchases were made with TFCU’s credit card after the promotional period ended.