How To Increase Credit Union Member Satisfaction With Data

by Ryan Getchell, on January 19, 2017

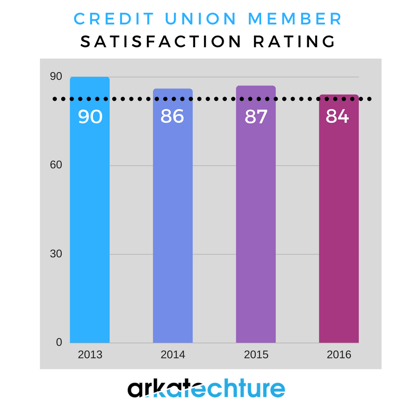

In a recent survey released by CFI Group, credit union satisfaction on a 100 point scale has dropped from 90 in 2013 to a 4 year low of 84 in 2016. The decrease is a bit odd, given that credit union growth topped up at nearly 4% according to CUNA Mutual Group.

So what is driving the decrease in credit union member satisfaction?

The CFI Group noted 4 opportunities that could lead to an increase in satisfaction. Here at Akratechture, we work with credit unions daily and are always interested in new ways to increase member satisfaction!

Is there an opening for data to used to help drive these opportunties? Let's take a look!

1. Measure the Member Experience

The CFI group notes that "In addition to managing key financial ratios, develop key member engagement metrics to provide a holistic view of performance". We've found that credit unions typically have a good grasp of their financial ratios- however, the tracking of key member engagement metrics could use some work. This is primarily due to how members are engaging across multiple platforms- member can now bank:

- In branch

- On a website

- On a mobile phone

- Via an automated phone teller

- By speaking with a contact center representative

The difficulty here is that the systems used by each of these methods are often not integrated. With radically different reporting and backends, how can credit unions see a full, 360 view of their members?

Unfortunately, the answer is often extracts from each system and manual manipulation in Excel in order to answer vital questions. This method is time consuming and fraught with error, decreasing the opportunities for credit unions to spot trends and take corrective action. A centralized data warehouse can solve this problem by bringing in all sources nightly. Reporting can be layered on top, so management can view up to date dashboards on their member engagement metrics.

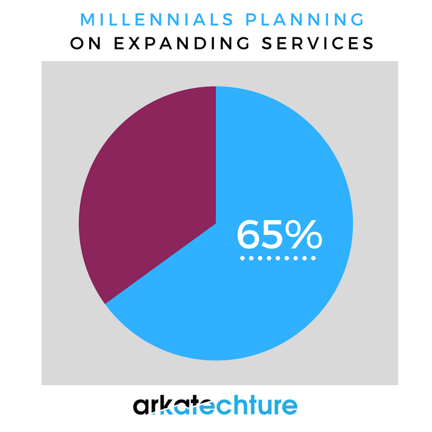

2. Target Millenials

Ahh the ever-elusive millenial. Everyone has an opinion on their tastes and preferences, yet they are often stereotyped and generalized in ways that are not truly representative of them. Further, millenials birth years spand almost 20 years from 1977 to 1995 (depending on the source you use). That sounds like a very diverse group of individuals, if you ask me!

So how does one quantify how millenials are banking? With data, of course!

We've found that analyzing the data around transactions by various age bands is very enlightening. When we analyzed transactions across banking platforms. As one might expect, the "online" channel was preferred across all age bands and was growing faster than any other channel.

However, when we split the "online" channel into website and mobile interactions, the trends shifted.

Website transaction growth was actually static, with the growth of "online" being driven by the mobile channel. Further, when comparing mobile channel transactions to branch transactions, we could clearly see that younger millenials preferred the mobile experience.

3. Lower Deposit Account Interest Rates

This was an interesting recommendation that I might disagree with, but CFI Group suggests to "Limit fees, deliver fee transparency, and be generous with fee cancellations; in return, Millennials will accept lower deposit account rates". I want to have my cake and eat it too- I want high rates and low fees! However, this might not be financially feasible for credit unions.

The awesome thing about credit unions is their member service. they often have products that can be so tailored to an individual, it's the perfect fit! But the backend operation cost to keeping this up can be enormous. This is why letting data speak to the effectiveness and profitability of a new product or feature is key.

Perhaps certain products can keep higher fees for certain age groups, or perhaps a credit union is keeping a low interest rate on a particular product because of the high operational cost to maintain it. Data can track the performance of products, which can be a guide when determining if a product should be expanded, maintained, or cut. So while the CFI Group's blanket recommendation is pertinent, every credit union is different and the data will guide you to a more targeted strategy.

4. Improve Online Processes

Investment in technology can be risky in today's budget-conscious environment. CFI Group notes "Current availability and functionality for online banking and apps are falling behind, particularly for older Millennials. Credit unions must continue to develop processes that are robust and seamless to keep up with these high expectations." This is where I go back to my example in #2.

If the data is showing that your members are moving to a specific platform, like mobile banking, figure out a way to move resources into that, while easing up in other areas. While there will always be a tradeoff, millennials will only continue to demand seamless online experiences. If investments aren't made now, credit unions risk losing the very clientele they seek to engage. Allow this argument to be won with better data and not a bigger job title!

In summary, I refer to Arkatechture's slogan, "We Build Data Driven Business." Data is now a strategic asset for every business, but only if it is complete, accurate, and timely. In today's complex technologic ecosystems, often the only way to fully understand your data is to get it in one place. If you are interested in learning more about how Arkatechture can help you unlock your data, let us know!