The Value of Data Analytics for Credit Unions

by Jessica Tomapat, on June 7, 2023

Originally published on CUTimes.com

The Credit Union Environment

Credit unions are facing new challenges and opportunities to rapidly improve their business performance, member experience, and their employee experience as well. With changes in consumer patterns due to COVID-19 and the macroeconomic impact of rising interest rates, member expectations have significantly shifted.

Implementing a robust data analytics program can allow credit unions to:

- Accelerate their ability to reach new potential members and market segments

- Modernize their digital member experience

- Expand their ability to excel in member service

- Grow and deepen relationships with members

- Improve profitability

The Urgency for Data Analytics has Never Been Higher

Credit unions must rapidly innovate to offer cutting-edge technology that will improve their business performance and member experience. The best way to do this is to dig into data, the best asset a credit union has for making and prioritizing critical decisions around innovation.

It's important to get the whole organization access to the right data in a timely fashion via reports and dashboards so they can understand and digest data, and use it to generate insights, make decisions, and take actions appropriate to their role.

This requires data stewardship from stakeholders who understand and can provide the right support for their department’s functions, goals, and what data points and key performance indicators are critical to them.

A data analytics solution enables a credit union to have a single source of truth and unify data at the member level across core banking, loan origination systems, digital banking, digital payment, and all other systems that support the credit union and its members. This also establishes a foundation for rapid innovation that could include adding new technologies and data sources and/or swapping out legacy systems for new cutting-edge technologies that will improve credit union performance and the digital and overall experience of its members and employees.

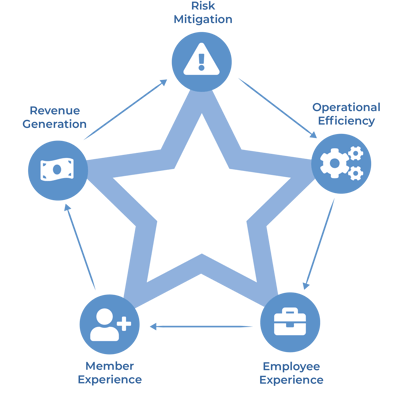

The Business Benefits of Data Analytics

Implementing a data analytics solution is a critical investment credit unions can make to identify and drive opportunities for making continuous improvements to business processes. Providing the right role-appropriate data across the credit union can help generate insights needed by the right people to make the right decisions at the right time in order to meet their member's financial goals, reduce costs, improve margins, and generate more revenue. Additionally, data analytics can help inform and improve decision-making in the current macroeconomic environment in key areas including:

- Mitigating risk

- Decreasing charge-offs and delinquencies

- Growing memberships and deposits, etc.

6 Questions to Ask When Moving Forward with Data Analytics

Below are some key questions to ask in order to develop an initial ROI-justified business case for moving forward with an advanced data analytics solution that will reduce cost, and establish a foundation for additional ROI business cases for generating more revenue and increasing margins:

- What manual steps are being taken for reporting and analysis today that can be eliminated with a data analytics solution that includes a data warehouse?

- Are there higher-value add activities that individuals who are doing this manual work could be doing instead?

- Example: In order to create a monthly regulatory report, someone on your IT team has to create/run a PowerOn job to obtain the requested data - hopefully with the right requirements - and transfer it to a shared drive so the business user can access it. Repetitive manual tasks like these cost crucial time that could be spent elsewhere.

- How much time is being spent on manual querying, exporting, compiling in Microsoft Excel, validating, and sending to a vendor that could be automated?

- Example: If you need to send an extract to a vendor with data from more than one loan source, how long does it take to get the data out of the multiple systems, combine it in Microsoft Excel, format it so it is cohesive, validate it, and then export out to the vendor?

- What vendors could possibly be eliminated or contracts reduced if your data was in a data analytics solution? (or projects avoided)

- Have you experienced any reduced efficiencies or costs because of incorrect or hard-to-access data and are you able to estimate the amount of these costs?

- In the past, have you had projects delayed or exceeding their budget because of data quality and/or the inability to easily aggregate the necessary data?

The ROI of Data Analytics

Your credit union will see significant returns on your investment in data analytics based on the experience of other credit unions. For example, a study by Nucleus Research documents the high return on investment that can result from an investment in data analytics.

According to this research, on average, for every dollar spent on a data analytics solution, customers generated $9.01 in benefits on an average project budget of $563,114. In addition, the return on investment from data analytics increases as the maturity of data analytics progresses across the following stages of a data maturity journey.

- The initial stage of automating reports captures process efficiencies, the Initial quick win for generating business value via cost reduction.

- In the tactical stage, organizations start leveraging analytics to improve decision-making focused on generating more revenue and increasing margins rather than just increasing productivity and reducing cost.

- In the strategic phase, enterprises deploy analytics across the organization to align daily operations with the goals of senior management (i.e., increasing the adoption of data analytics across all key functions and roles).

- As organizations experience the benefits of leveraging ‘Big Data’ to proactively make changes and extend their analytics to larger data sources, this predictive phase yields the highest average ROI.

How Else Can a Credit Union Create Value with Data Analytics?

Below are just a few examples of credit unions that have generated a return on their investment of implementing a data analytics solution:

Credit unions were able to improve staffing efficiency by:

- Adjusting staffing to match transaction activities throughout the day

- Self-servicing; reducing dependency upon IT organizations to create reports

- Purging records from systems to increase processing speed, etc

Credit unions were able to eliminate work by:

- Eliminating extensive manual work to create data sets, aggregate them or report on them

- Eliminating historical reports run automatically by IT

- Eliminating manual data entry,

- Eliminating the need to check data integrity/accuracy, etc.

The Time is Now

Don't risk falling behind with the current climate, competition, and volume of data your credit union accumulates as it grows. The timing has become urgent for credit unions to look at options for upgrading their data analytics program.

So what are you waiting for? Don't make the mistake of not keeping your technology updated with the current climate, competitors, and the volume of data your credit union is accumulating as it grows. Need some help getting started? Talk with a data expert at Arkatechture today.

For a simple 4-step process, check out this ROI One-Pager

References:

1. https://nucleusresearch.com/news/roi-of-business-analytics-increases-significantly-as-solution-matures/