The Credit Union Member Experience Lifecycle

by Hannah Barrett, on March 22, 2022

What is the Member Lifecycle Journey?

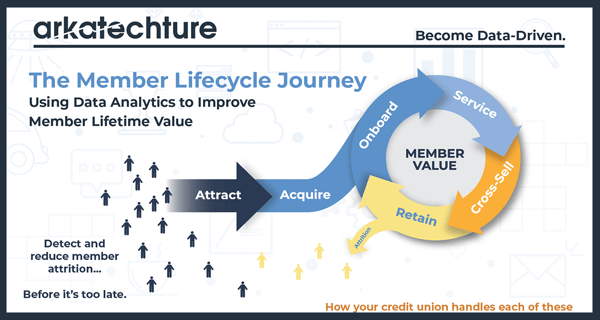

The member lifecycle journey diagram above puts a framework around the member-credit union relationship. This conceptualizes the member's experience from their first application all the way through to attrition or conversion into being their primary financial institution.

The framework helps credit unions understand what data points they can use to measure each step along the way. With that in mind, the CU must agree upon what strategies and business outcomes are key to understand and measure at each stage. Those stages are as follows:

Establishing a mature data analytics ecosystem is required to achieving this advanced level of analysis & insight both historically and looking forward. With that in place, descriptive and predictive analytics can be employed to manage this cycle. The next question is...

How do you manage the relationship and lifecycle, and what kind of analytics can be employed to manage that relationship to create value?

At each stage of the journey, you have the opportunity to build additional member value by managing risk and fostering good member relationships based on both the credit union’s goals and the member individual expectations & needs.

Let's break down each of the six stages of the member lifecycle journey in more detail below.

1. Attract

Use data-driven insights to attract brand new members with highly relevant messaging. For example, create initial member attraction with offerings such as an indirect auto loan. Questions to ask when planning this stage:

- What member demographic are you trying to attract?

- What key metrics will we measure?

- What outcome will be defined as success?

- What acquisition costs do you project?

- What is the value of adding a new member, is it more than the average acquisition cost?

2. Acquire & Onboard

The onboarding process is a key step in building a long-term member relationship.

- How positive of an experience is your onboarding process for new members?

- How many people are abandoning a partially completed application?

- How efficient is the onboarding process for your credit union?

- In what ways can the onboarding process be improved?

3. Service

Servicing members includes the everyday operations of managing someone's accounts, and continually fostering a good relationship when a member calls with a problem. Predict and improve the overall member experience (and value) by analyzing each channel and product.

There are countless data points created each time a member calls you or requests help through various channels. Integrating your call center into your business intelligence reports can help you identify improvements to improve the member's experience at each opportunity.

4. Cross-Sell & Build Loyalty

Segment members in order to identify timely cross-selling opportunities or take action on members at risk of attrition.

One way to meet the needs of both credit union and member, is gaining the ability to predict what product is a good fit for a given member, through data and member habits. Arkatechture offers an analytical model, Next Best Product, which allows credit unions to analyze how they can personalize offerings more to a specific client based on behaviors, preferences, and anticipated needs.

Adding more to a member's portfolio by offering relevant products and services deepens your relationship, and increases retention.

5. Retain & Attrition

Each step impacts a member’s overall experience and therefore, their retention and lifetime value.

- How many members are retained within a certain period of time?

- How many are lost?

- What ratio of retention to attrition are you aiming for, and how are you going to get there?

- How do you retain members past their first service through your credit union, such as a loan?

- Are there any like-factors for members that did leave?

- When and how often did they login to their online banking accounts?

How your credit union handles each of these steps determines member lifetime value: how much a member is going to cost your credit union to acquire, service, and retain versus what you gain in revenue.

Determine which of these processes need improvement at your credit union, and what the priorities are. Once you have this determined, build a roadmap of how data analytics are going to help the process of achieving your credit union's goals at each step of the member lifecycle journey.

So... How do you use your data to do this?

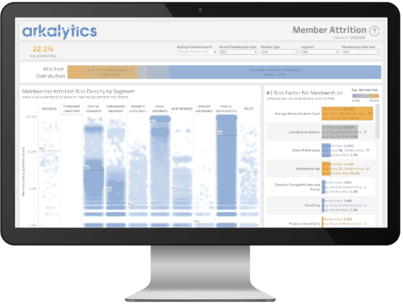

Here's an example; with Arkalytics, one of the many dashboards offered is a member attrition model. This model is predictive. Based on this historical data, the model helps you predict who is at risk to attrite and key risk factors, so you can then analyze the reasons why, and be proactive.

Want to learn more about the dashboard above and other analytical models built for credit unions?